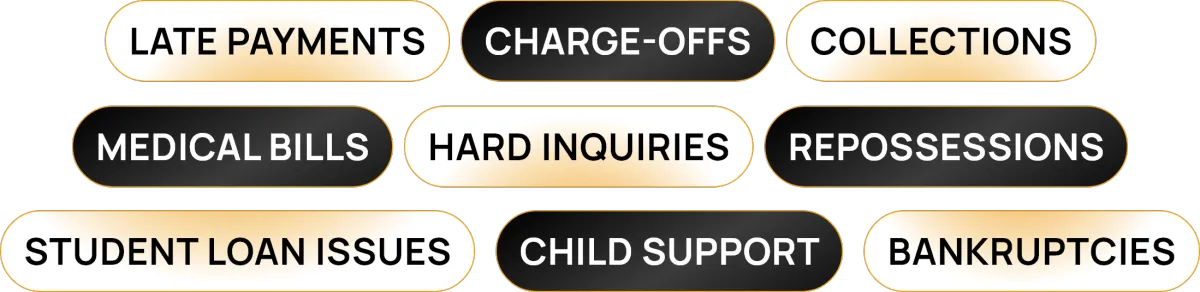

WHAT WE FIX

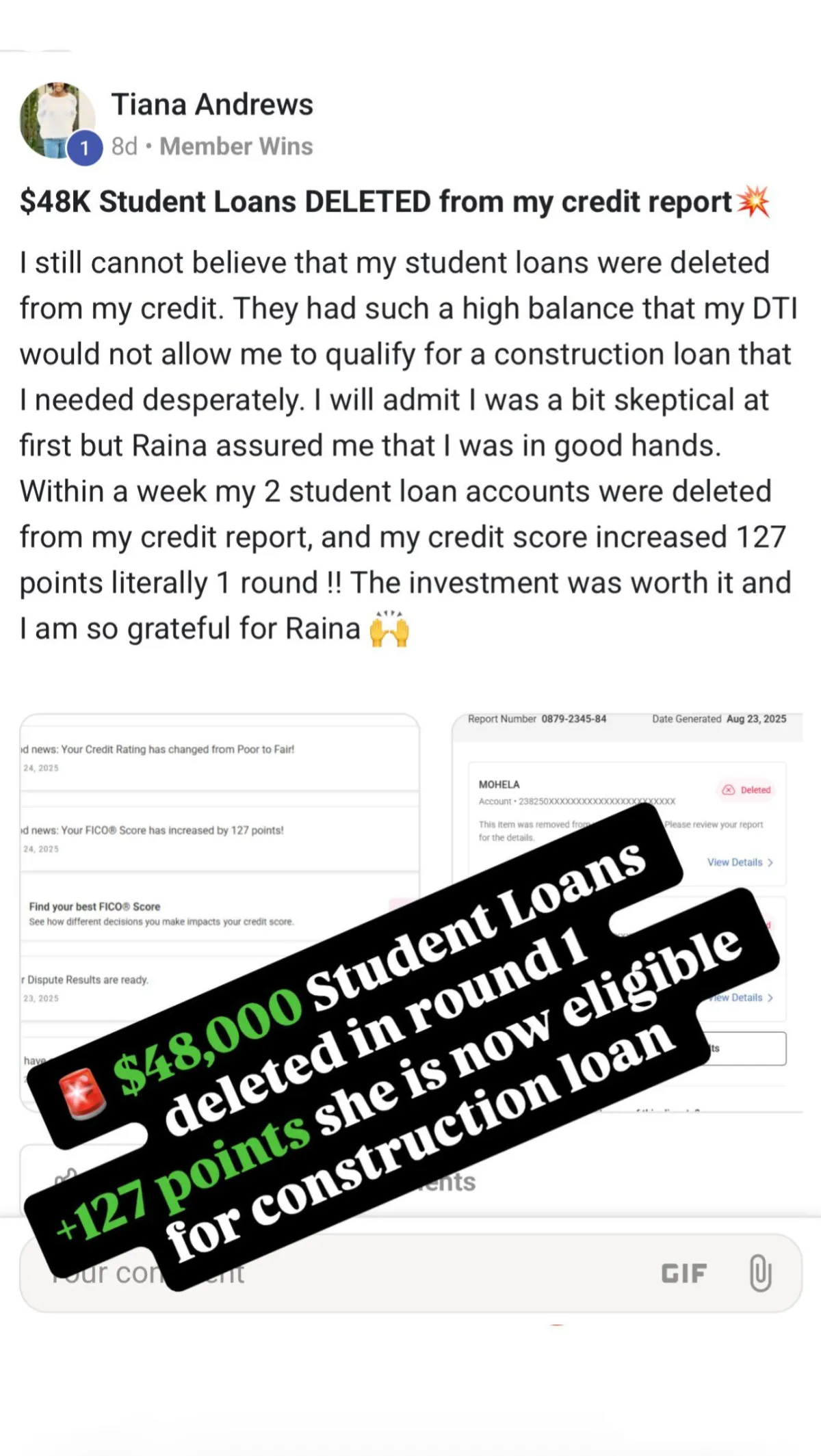

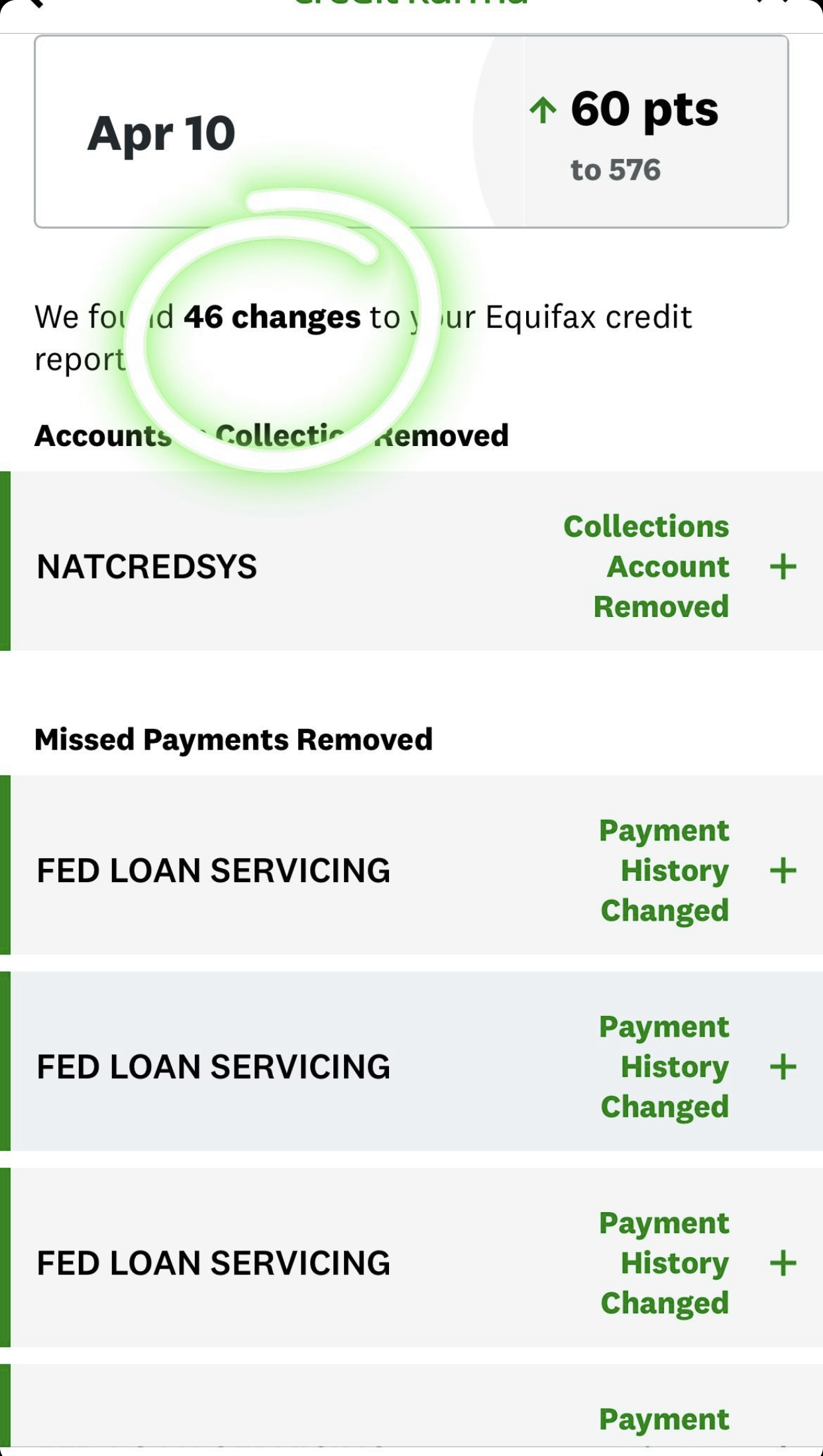

We work to remove or challenge:

If it’s inaccurate, outdated, or unverifiable — we fight it.

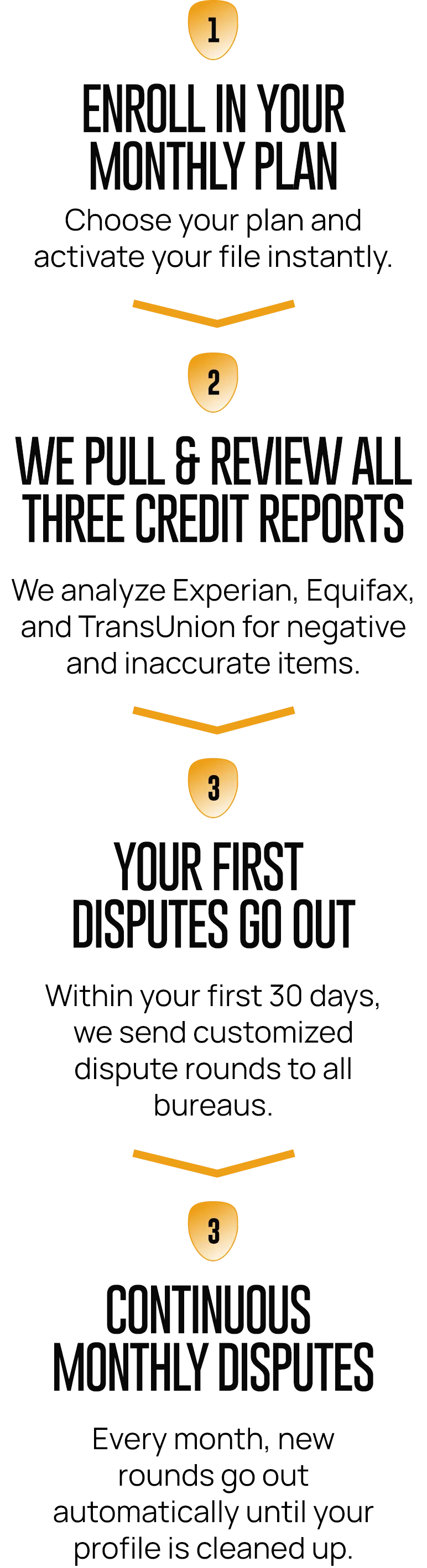

How it works

About (dollceo)

RAINA LASSITER

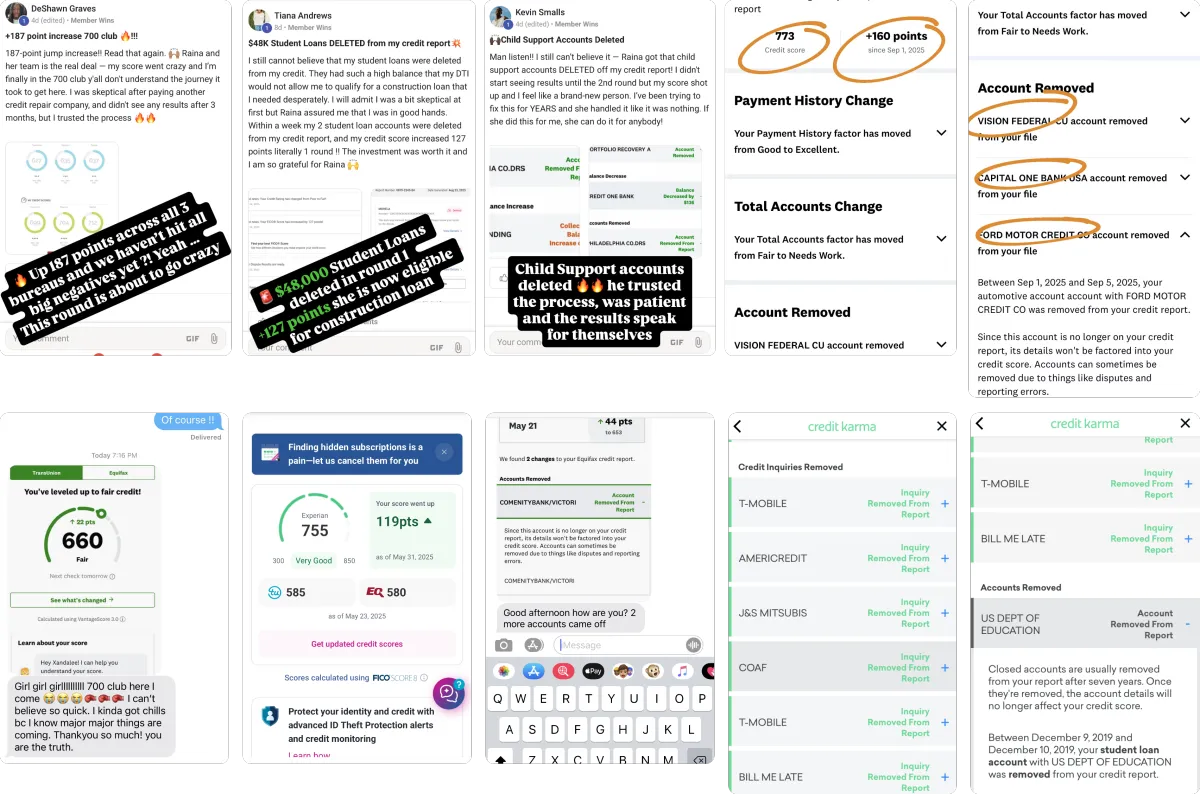

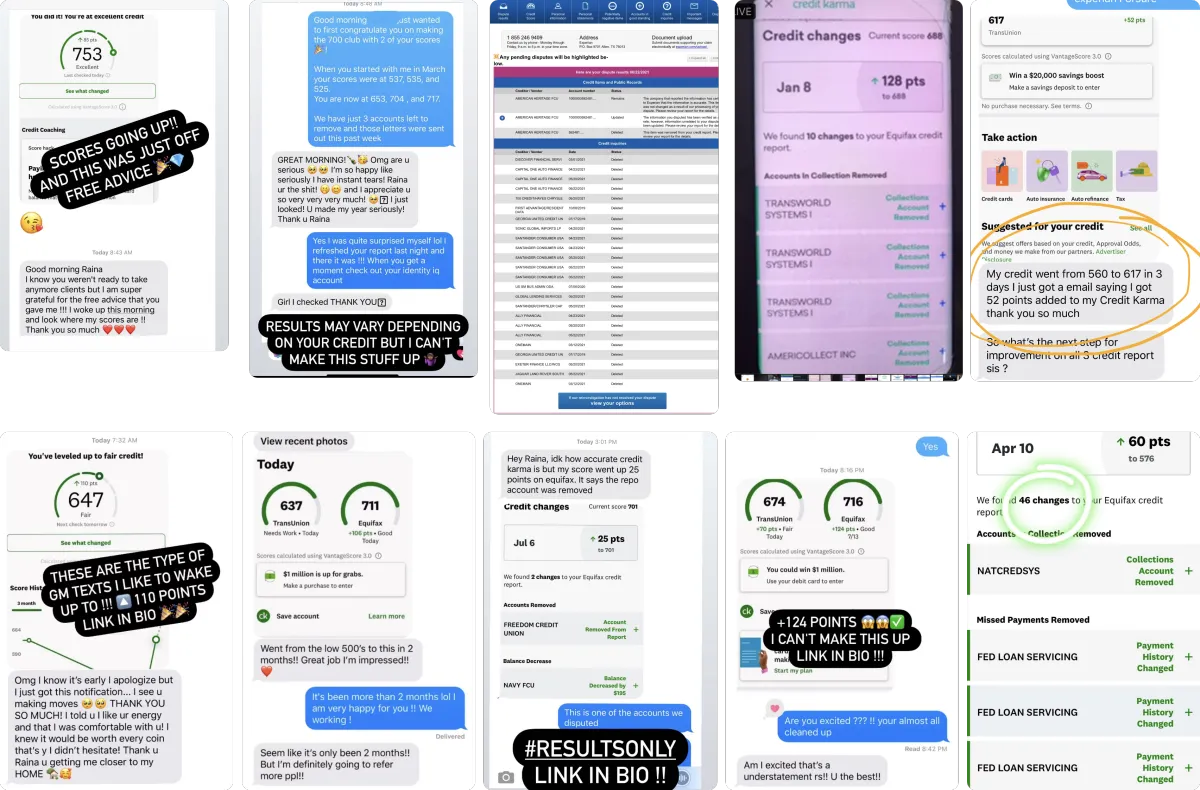

Hi, I’m Raina Lassiter — founder of CEO Capital — and I know exactly how life-changing great credit can be, because I had to rebuild mine from the ground up.

Not long ago, I was overwhelmed with debt and stuck with a credit score in the 400s. Every denial, every setback, and every financial obstacle felt impossible to overcome. But I made a decision: bad credit was not going to define my life.

By using the same proven strategies I now teach, I transformed my credit from the 400s to an 800+ score in under a year. That shift didn’t just repair my credit — it opened new doors. I eliminated debt, achieved true financial freedom, and began leveraging credit to create cash flow, invest, and build wealth through business.

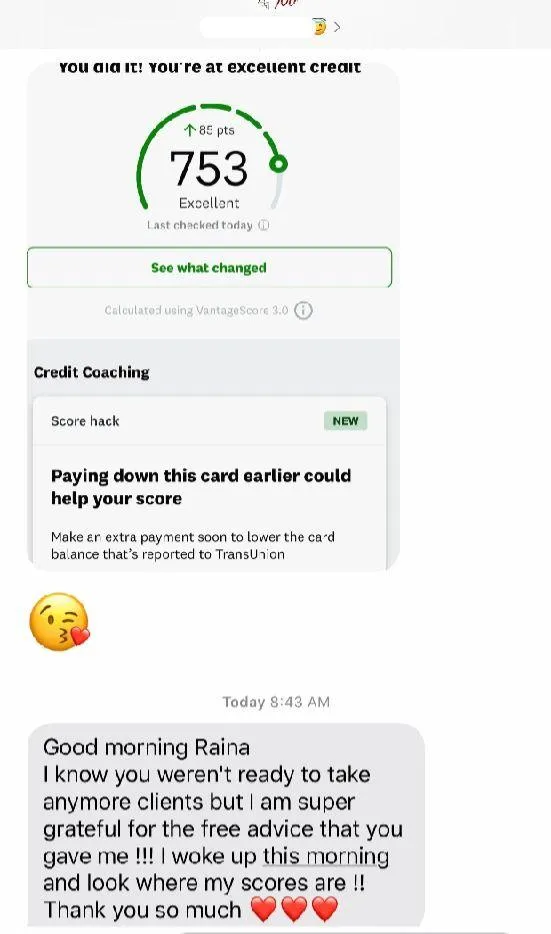

Today, I’m dedicated to helping others experience that same transformation. Through CEO Capital, I support individuals who are ready to repair their credit, rebuild their financial confidence, and step into opportunities they never thought possible. I also mentor aspiring entrepreneurs, teaching them how to use both personal and business credit strategically so they can start, grow, and scale with confidence.

What sets me apart is simple: I’m relatable because I’ve lived this journey myself.

I understand the frustration of constant denials, the embarrassment of bad credit, and the stress of financial instability. And I also understand the freedom that comes when you finally break through.

If you’re ready to rebuild your credit, transform your finances, and learn how to use credit as a tool to create real wealth, I’m here to guide you — every step of the way.

Your fresh start begins the moment you decide you deserve it. Are you ready?

Do I Need A Consultation?

Consultations are optional and not required. Upon purchasing you will not receive a consultation unless you have submitted a form, you will only receive onboarding instructions and communication will be done by email and client portal only. If you feel like you need a consultation, please complete the form. We get things done without having to have a phone call, our communication is great! Here is the link for assessment:

How Long Does It Take To See Results?

We’d love to have you on board! Simply hit the button below, call our team, or DM us, and someone will be in contact with you within 24 hours.

What Items Can You Remove?

We dispute closed/negative accounts only.

How Can I Improve My Score?

Start with us today! Whether it’s getting negative items removed or positive lines added, we can help!

Where Can I See My Credit Reports? Is There a Charge for This?

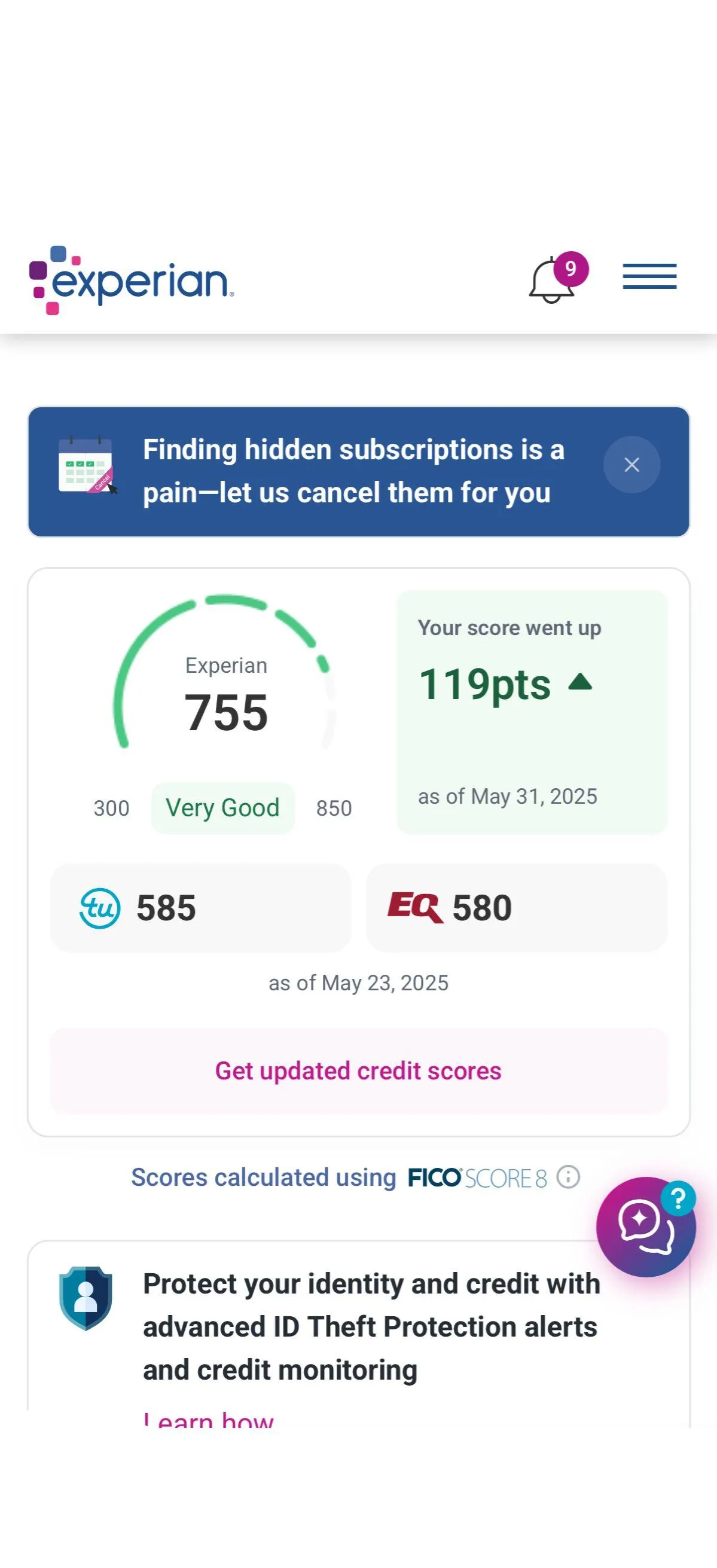

We use Identity IQ because it includes all 3 credit reports (Experian, Equifax, and Transunion). While we do not charge a monthly fee for credit repair, Identity IQ does charge monthly to provide you and us a refreshed copy of your credit report each month.

If you use our affiliate link, the monthly charge will be around $23. It is mandatory that you are up to date with your Smart Credit payment so we can check for updates and send new rounds out to the credit bureaus.

How Long Does it Take to Fix My Credit?

Please allow 2 business days after all information has been received for us to prep and mail your disputes out to the 3 consumer reporting agencies. Once they are delivered to them, processing time starts!

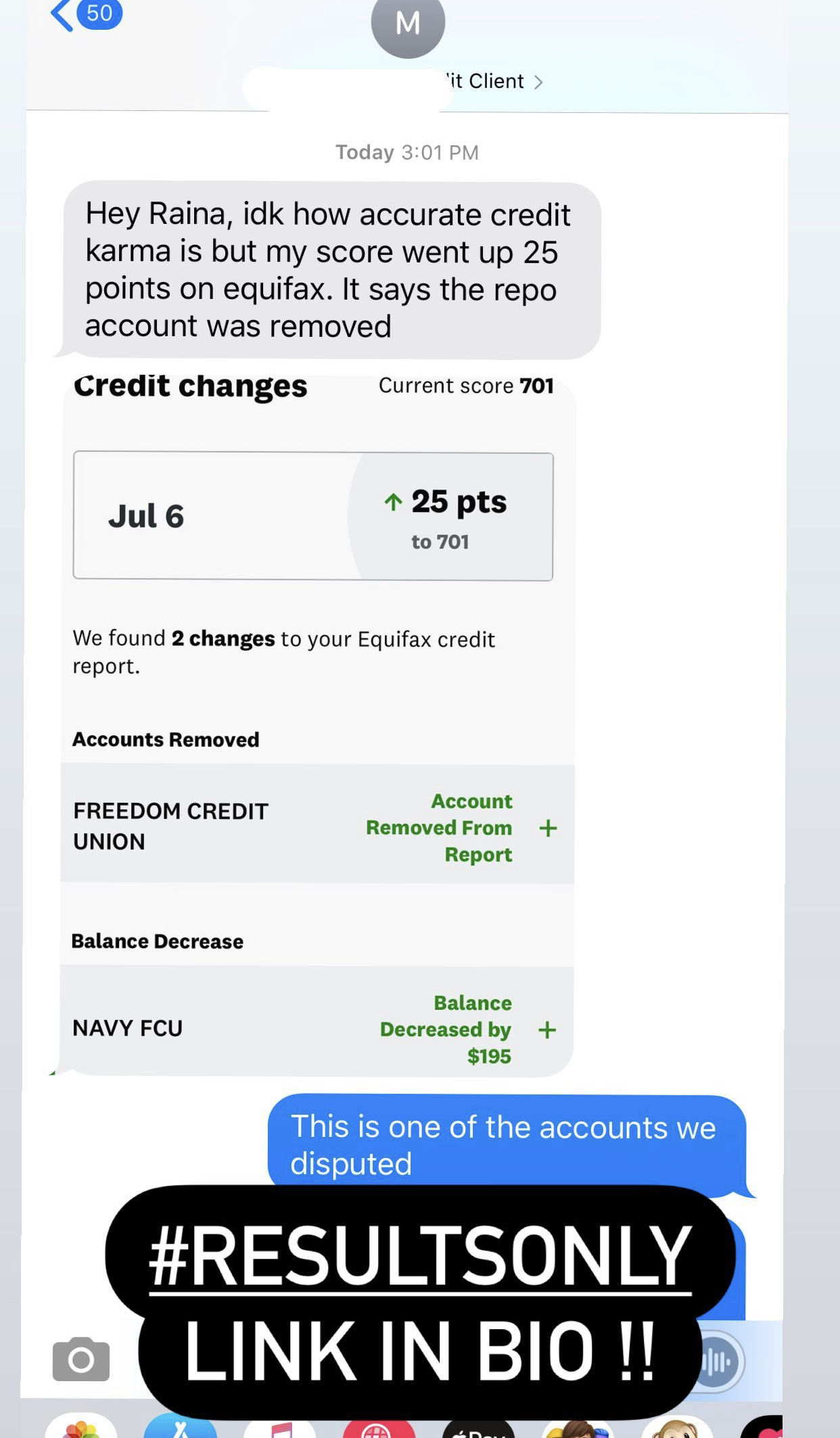

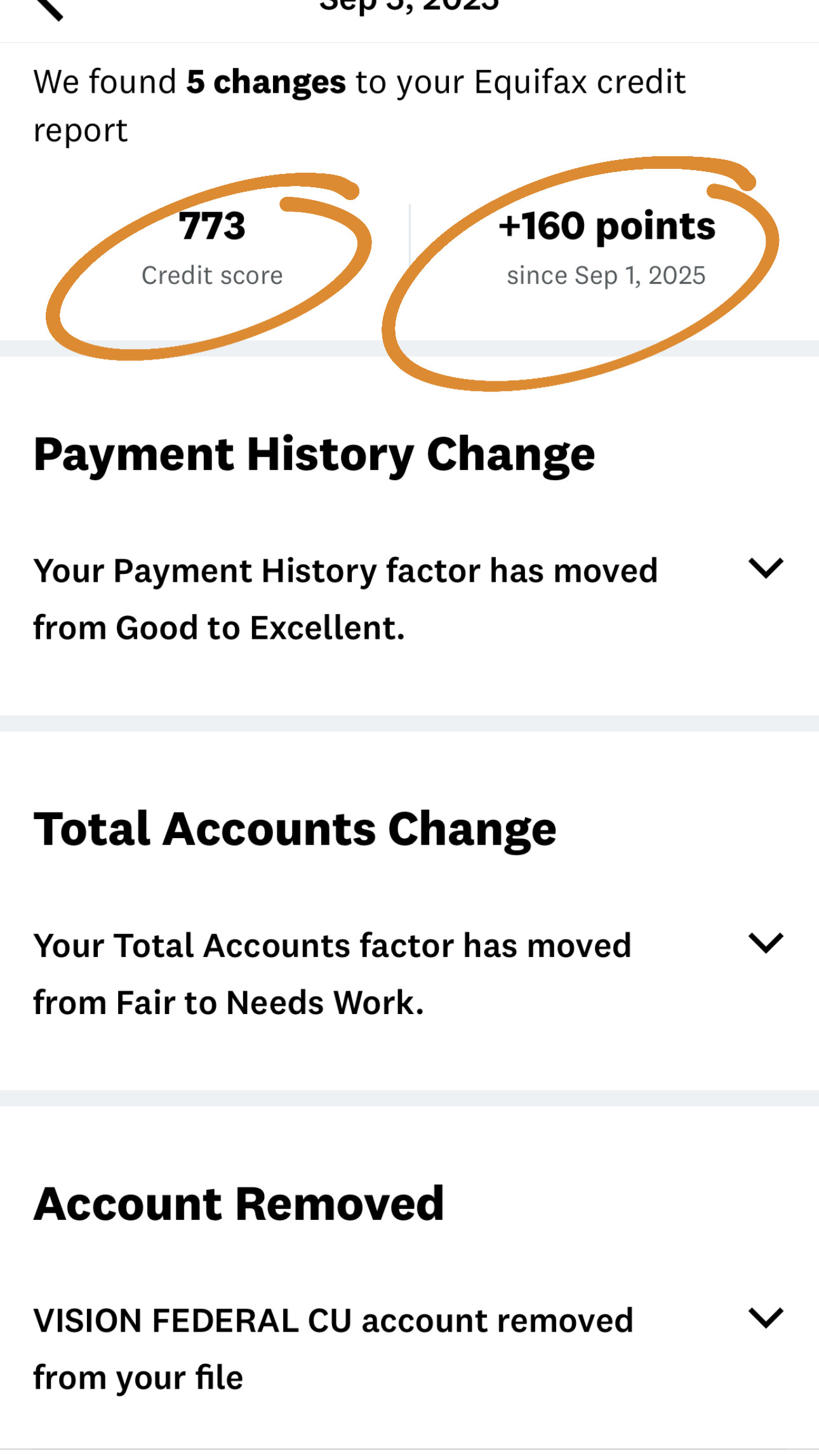

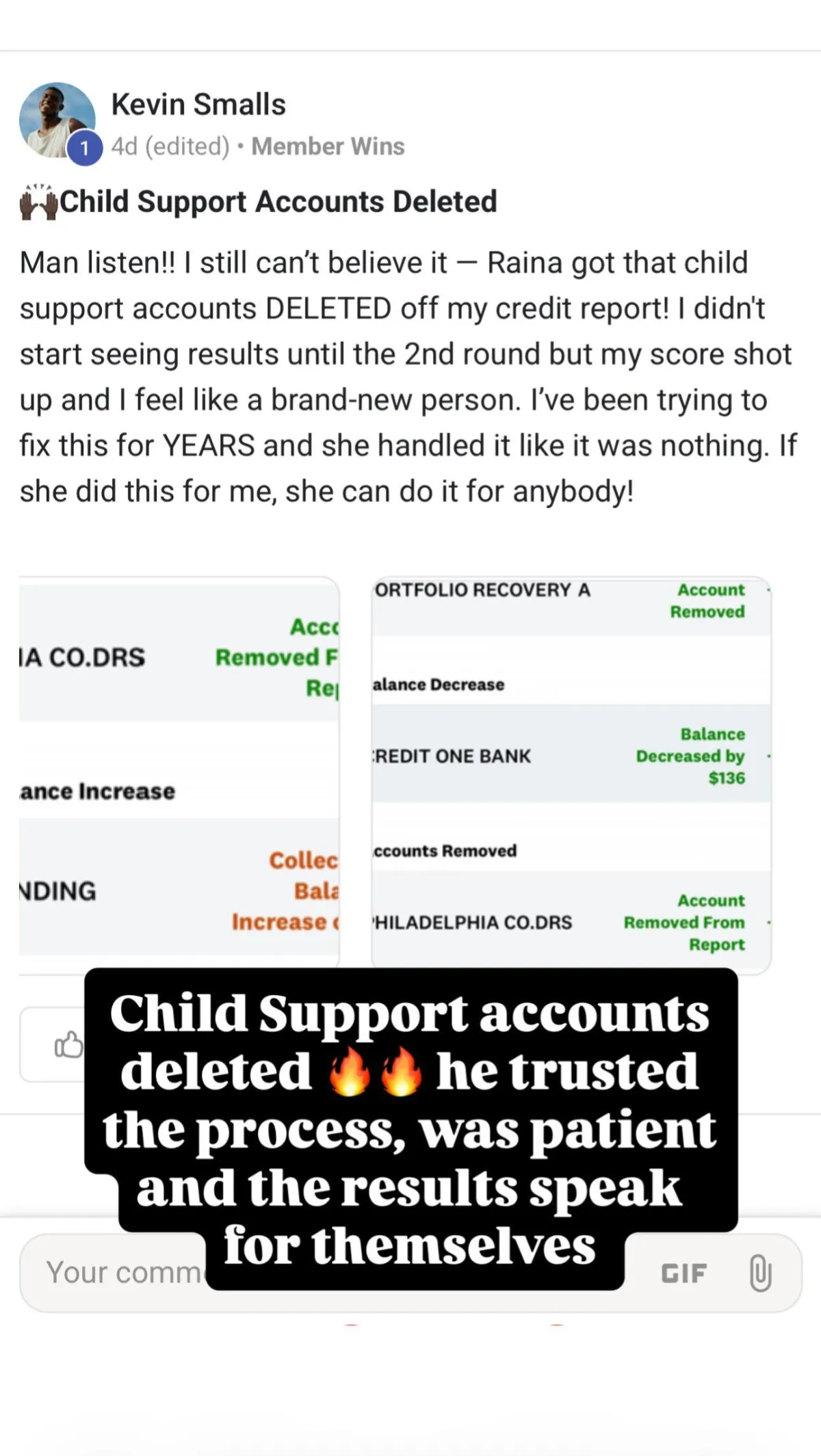

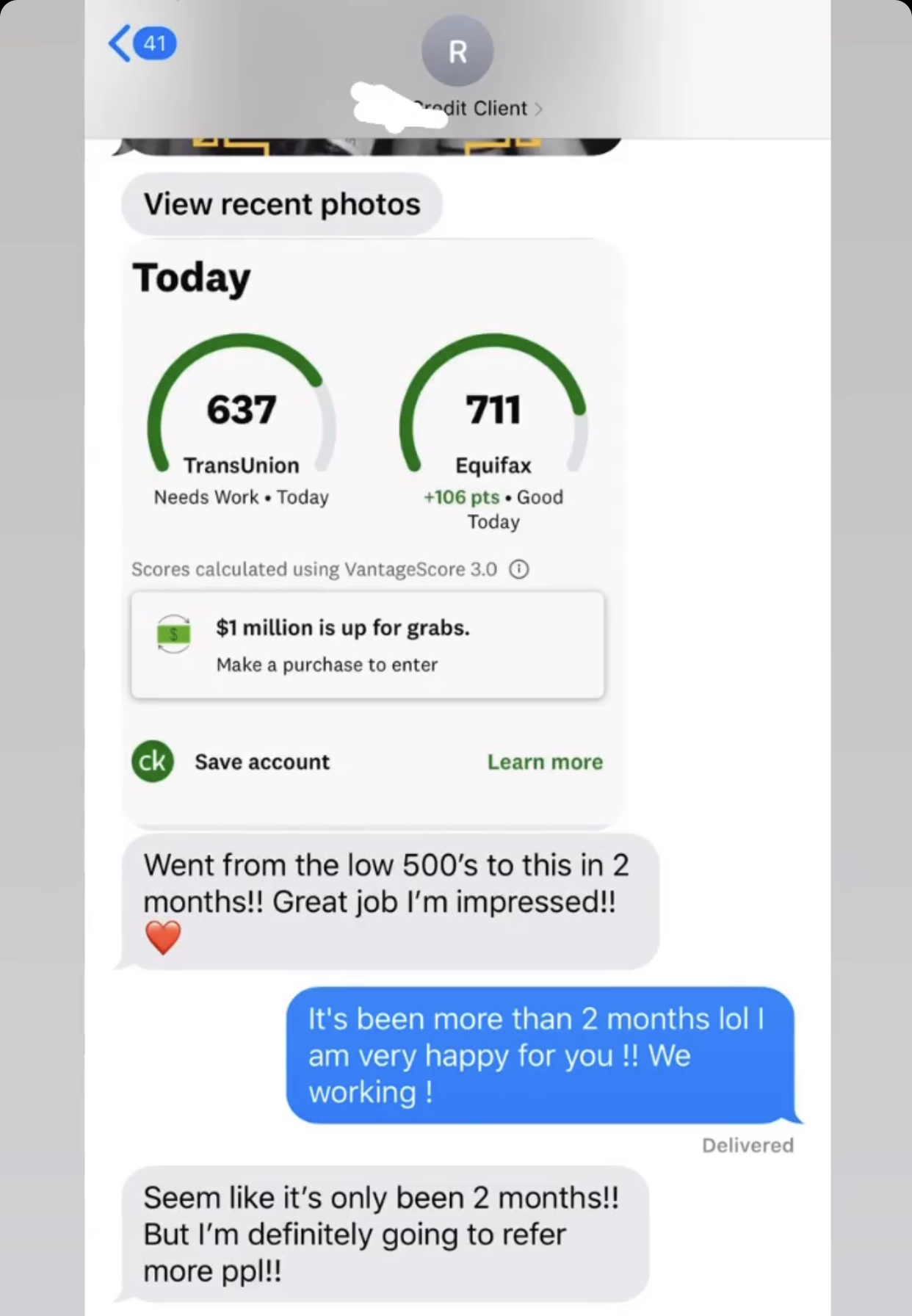

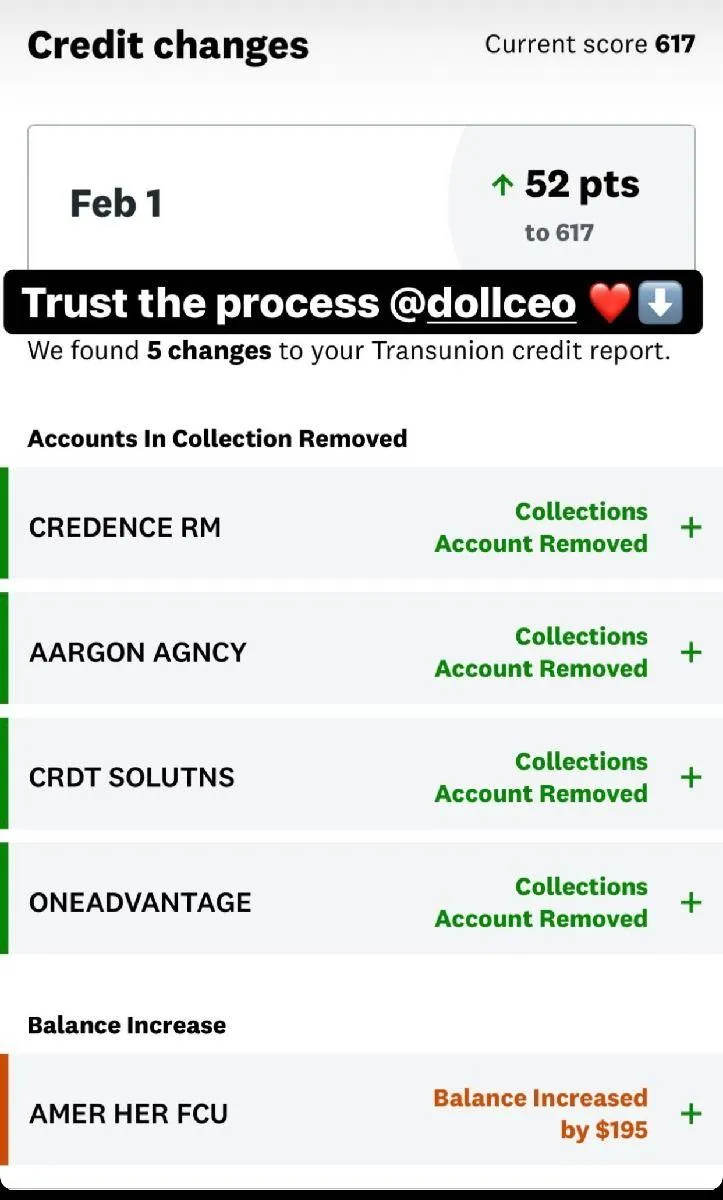

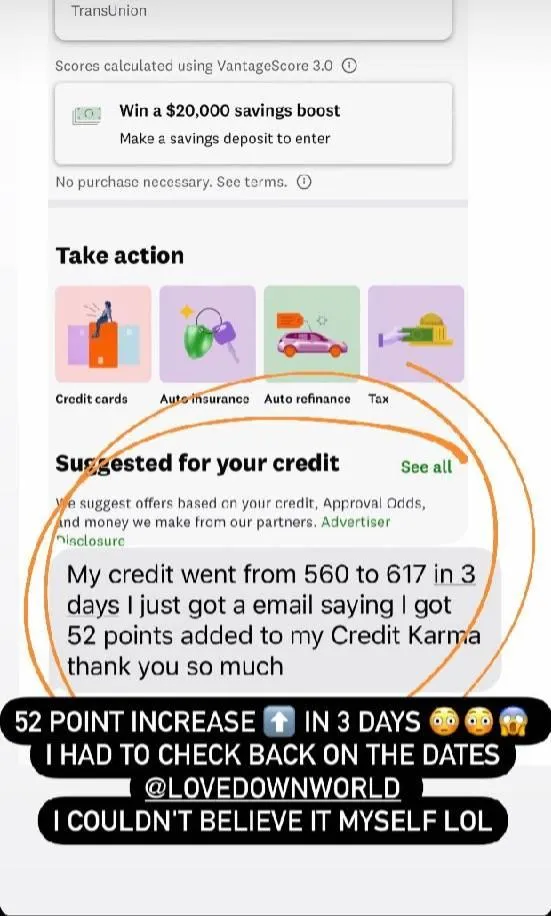

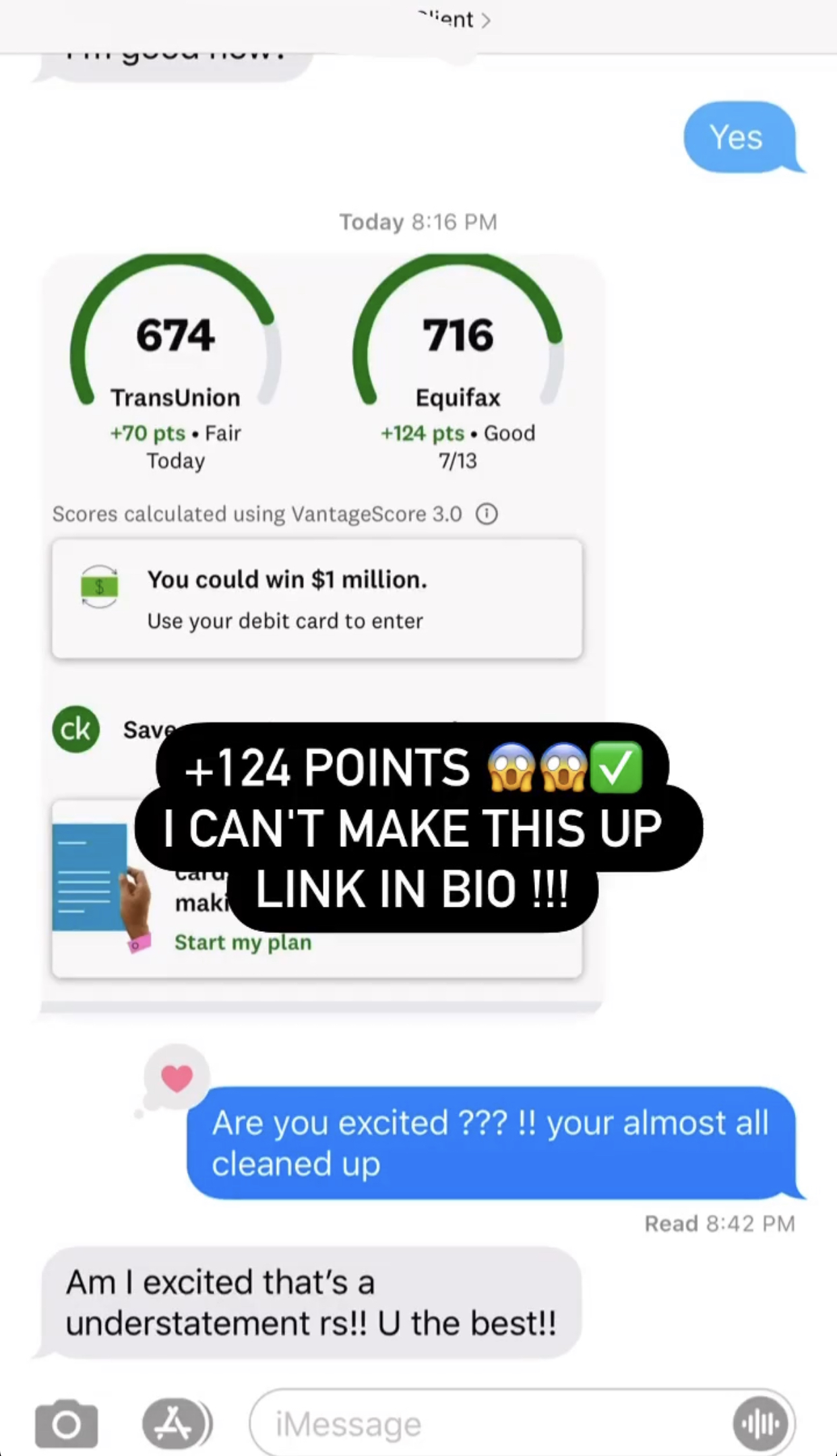

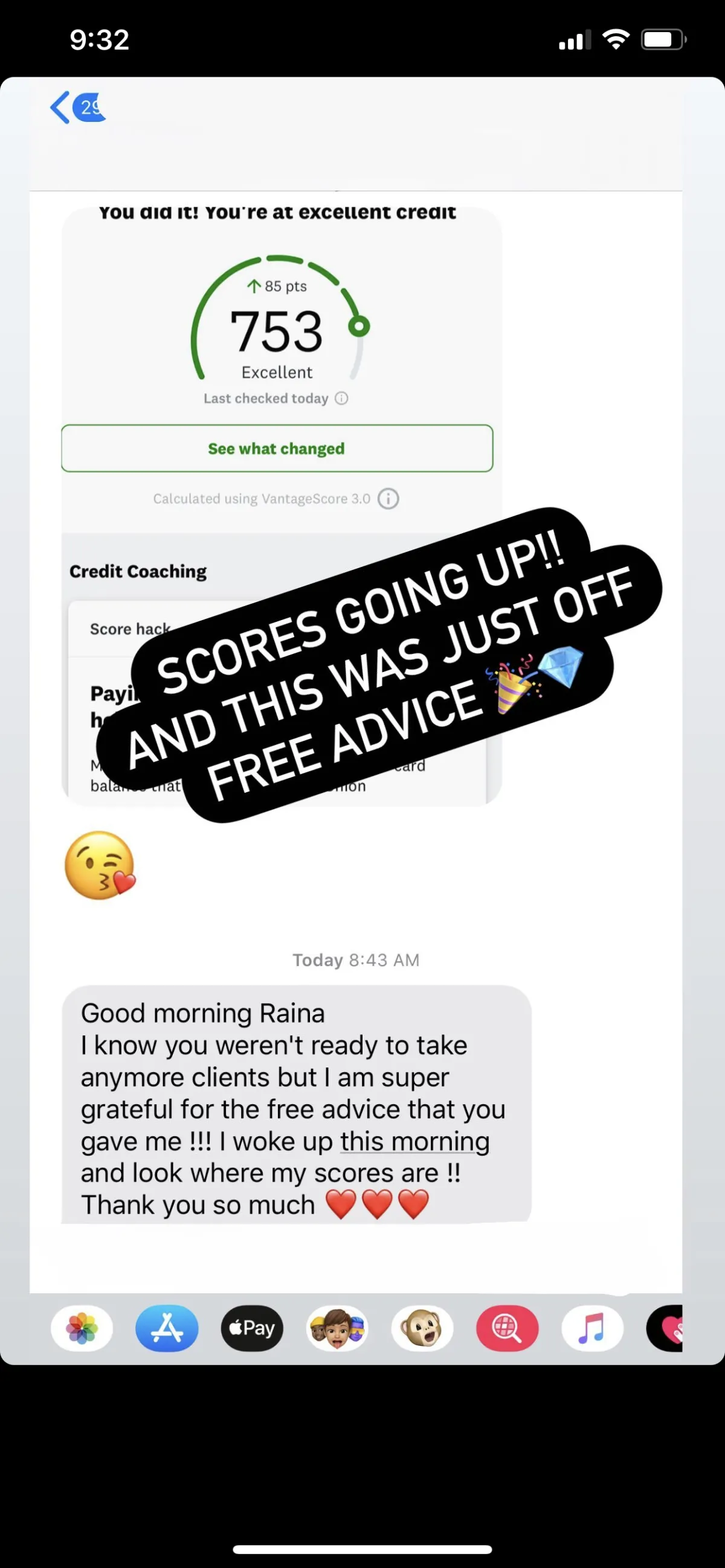

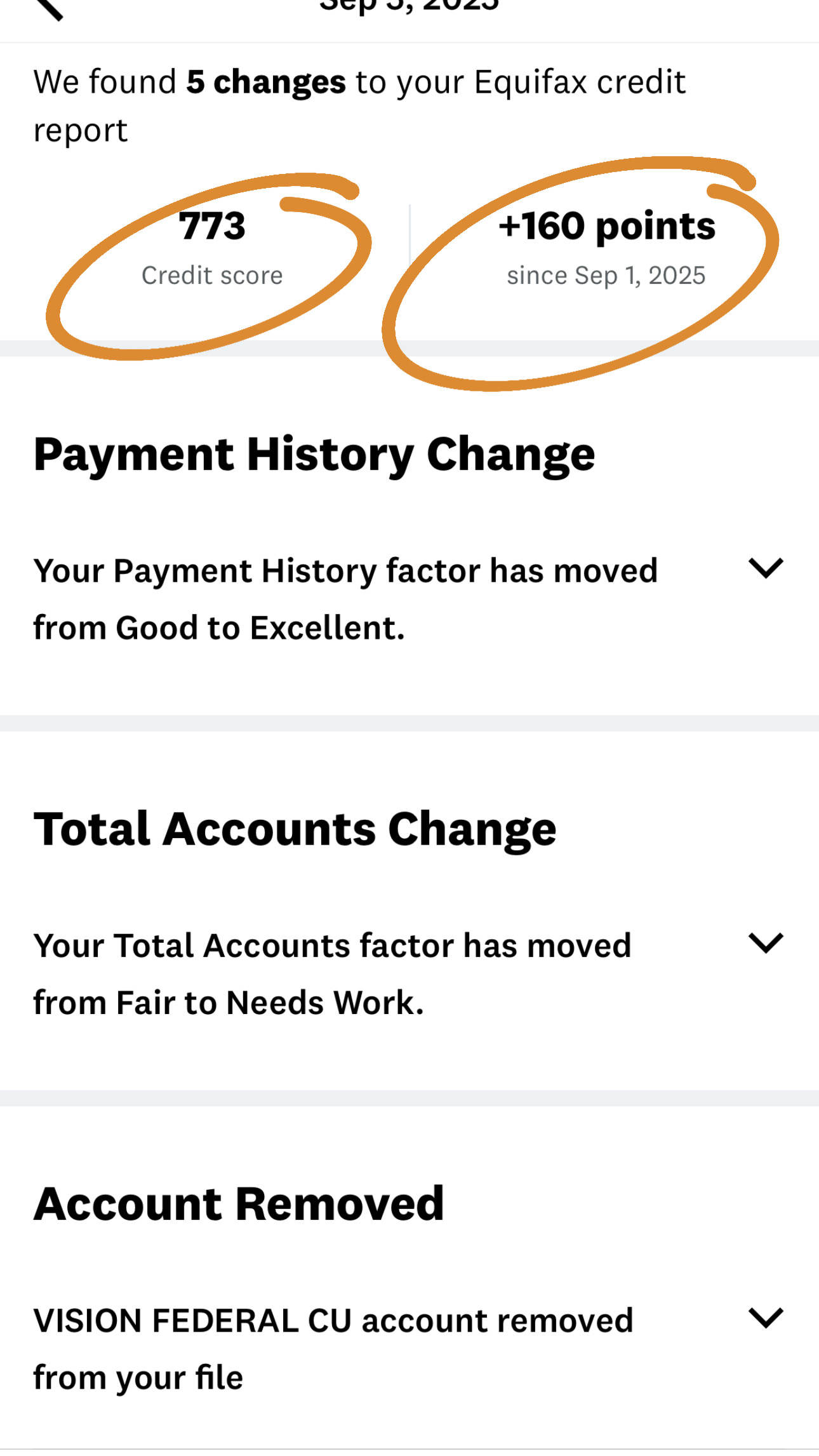

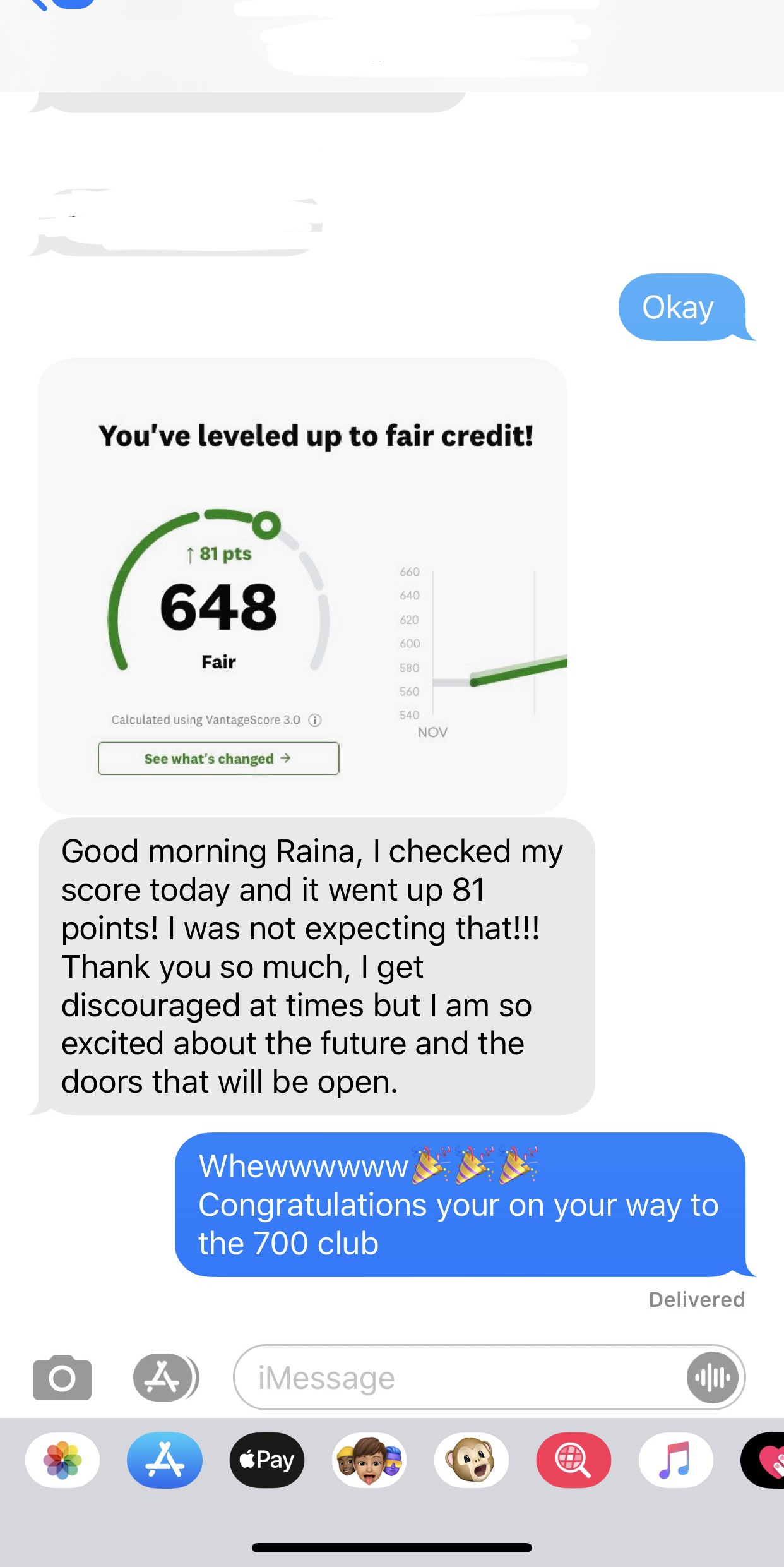

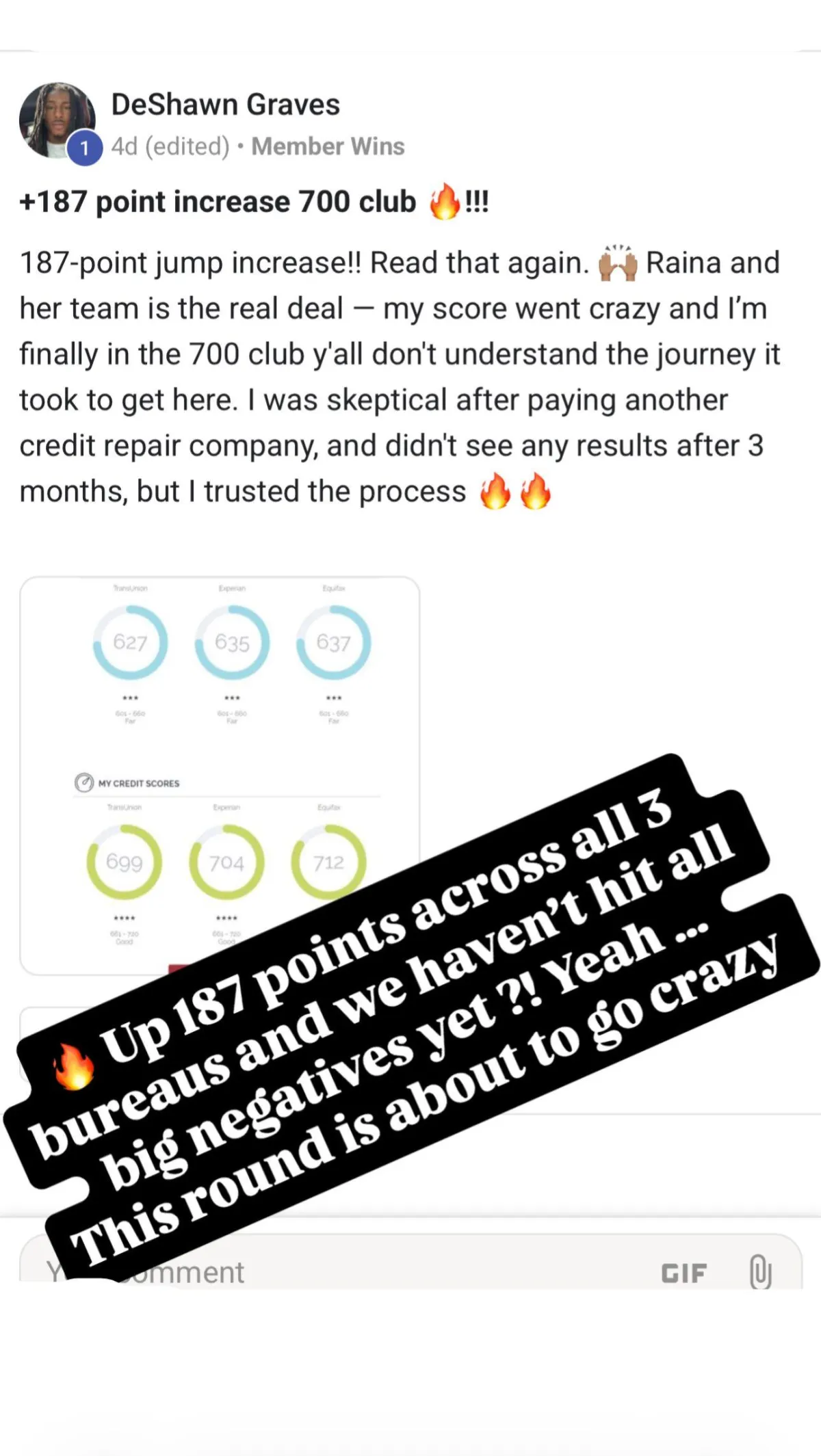

The basic package includes 3 rounds (typically takes around 3 months), and the premium plan includes 6 rounds (typically around 6 months). However, the majority of our clients start seeing results in the first 90 days.

Remember, we are credit repair specialists, not magicians. We fight on your behalf, using consumer laws each month to get accounts removed. Credit repair takes patience! With that being said, there are no refunds.

How Long Until I Start Seeing Results?

You can expect to see results in at least 30 days, with it taking up to 90 days in some cases.

How Do I Get Started?

We’d love to have you on board! Simply hit the button below, call our team, or DM us, and someone will be in contact with you within 24 hours.

How Is Your Credit Repair Service Priced?

Our credit repair services are provided at no required cost. We do not charge mandatory fees for credit repair. Instead, our organization operates on a donation-based model. Any contributions made are voluntary donations used solely to help cover operational expenses such as credit monitoring systems, dispute software, compliance tools, administrative costs, and staff support.

Donations are not required to receive services and do not impact the level or quality of service provided.